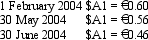

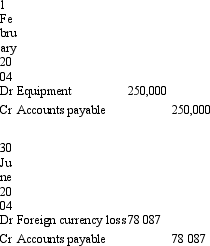

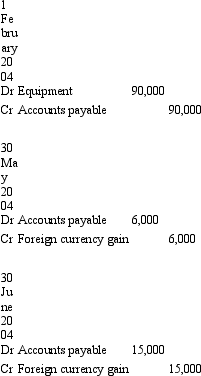

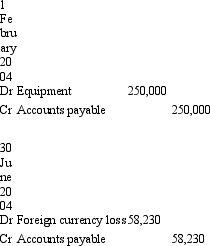

On 1 February 2004, Morinda Ltd completes a binding agreement to purchase a hydraulic lift from a manufacturer located in Germany. The cost of the equipment is €150,000. The construction of the lift is completed on 30 May 2004, and it is considered to be a qualifying asset according to AASB 123. The amount owing has not been paid by reporting date 30 June 2004. The following is information about the exchange rates:

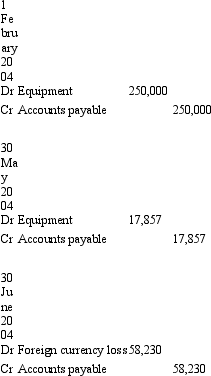

What entries are required to record the transaction and subsequent events in accordance with AASB 121 (rounded to the nearest whole $A) ?

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q22: The effect of a fall in the

Q24: An exception to the requirement that foreign

Q26: Examples of monetary items that may be

Q27: AASB 121 requires that foreign currency monetary

Q32: On 1 July 2004 Waugh Ltd enters

Q33: Sure Ltd purchased goods for £210,000 from

Q37: Apart from some limited exceptions,AASB 121 requires

Q38: The spot rate is defined in AASB

Q39: The effect of an increase in the

Q39: On 1 July 2006 McGrath Ltd enters

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents