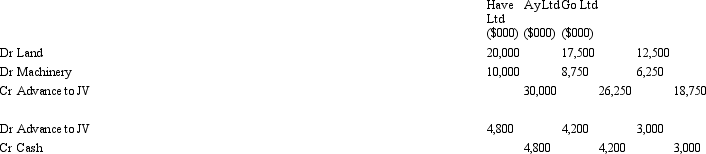

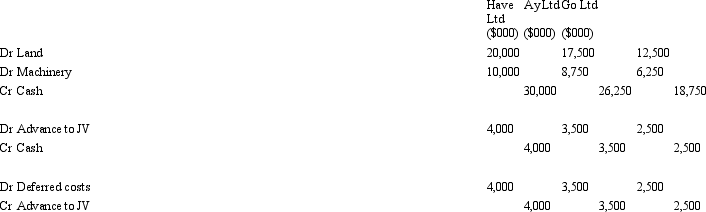

Have Ltd, Ay Ltd and Go Ltd contractually form a jointly controlled operation on 1 July 2003 to undertake a bauxite mining venture. The three companies agree to contribute the following amounts of capital to the venture in the same proportion as their rights to the assets and outputs:

The funds are used on 1 July 2003 to purchase the mining site for $50 million and drilling and other heavy machinery for $25 million. The balance of $25 million will be called on by the joint venture manager as required.

The following information relates to the year ending 30 June 2004:

Total cost of production $10,000,000. These costs have been deferred in order to amortise them as mining commences.

Of the total costs of production all but $3,000,000 have been paid in cash.

The joint venture manager called on the venturers to contribute a further $12,000,000 in total with each venturer contributing the appropriate portion according to their share in the joint venture (provided above) .

What entries would be required to record the formation of the joint venture and the transactions for the year ended 30 June 2004?

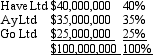

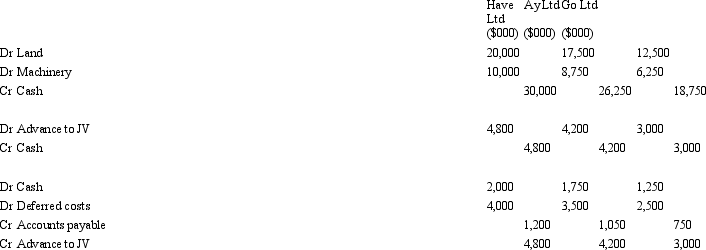

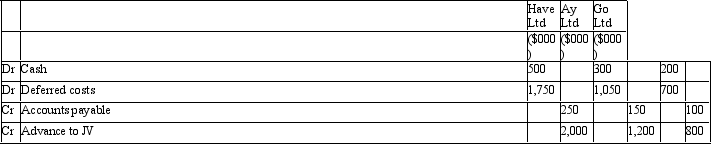

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q5: The one-line method of accounting for joint

Q11: AASB 131 does not require the use

Q13: Where an entity has significant influence but

Q15: A partnership can never be a jointly

Q17: AASB 131 requires that the liabilities of

Q22: Creed Ltd and Nickleback Ltd enter into

Q23: Bush Ltd and Forest Ltd enter into

Q24: Go Ltd, For Ltd and It Ltd

Q26: Sting Ltd and Pink Ltd enter into

Q34: Where an asset contributed to a joint

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents