Happy Ltd, Go Ltd and Lucky Ltd contractually form a jointly controlled operation on 1 July 2003. The three companies agree to contribute the following amounts of capital to the venture in the same proportion as their rights to the assets and outputs:

The funds are used on 1 July 2003 to purchase land for $15 million and equipment for $5 million. The balance of $10 million will be called on by the joint venture manager as required. Go Ltd and Lucky Ltd borrowed $10 million and $3 million respectively to finance their contributions to the joint venture.

The following information relates to the year ending 30 June 2004:

Total cost of production $6 million. These costs have been deferred in order to amortise them as production commences.

Of the total costs of production all but $1.5 million has been paid in cash.

The joint venture manager called on the venturers to contribute a further $8 million in total with each venturer contributing the appropriate portion according to its share in the joint venture (provided above) .

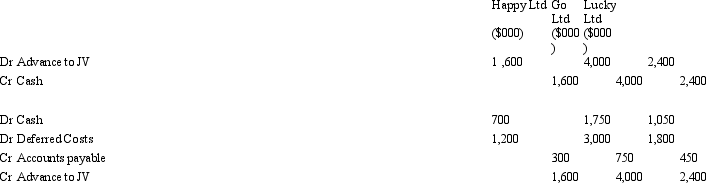

What entries would be required to record the formation of the joint venture and the transactions for the year ended 30 June 2004?

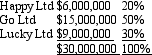

A)

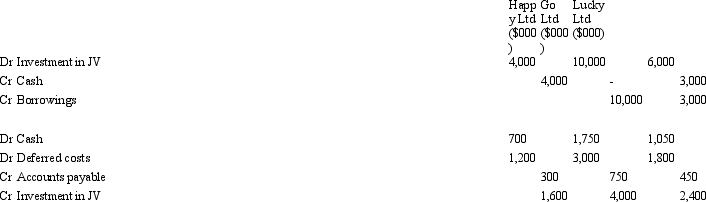

B)

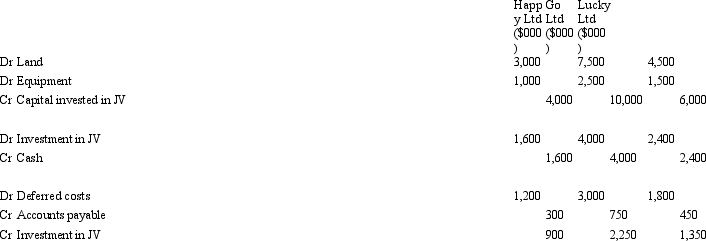

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q42: On 30 June 2013, Perkins Ltd, Thorpe

Q42: Items required to be disclosed in summary

Q44: Rolling Ltd and Stones Ltd enter into

Q45: On 30 June 2013, Perkins Ltd, Thorpe

Q46: A venturer that recognises in its financial

Q48: Tubular Ltd and Bells Ltd enter into

Q50: Which of the following statements is in

Q51: When accounting for a jointly controlled operation,and

Q52: Which of the following statements about jointly

Q53: AASB 131 requires which of the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents