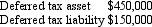

Bogart Ltd has the following tax balances as at 30 June 2009

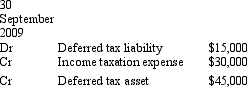

The balances were calculated when the tax rate was 30 per cent. On 30 September 2009, the Government announced a change to the company tax rate to 40 per cent, effective immediately. What is the journal entry to adjust the carry-forward balances of the deferred tax asset and deferred tax liability?

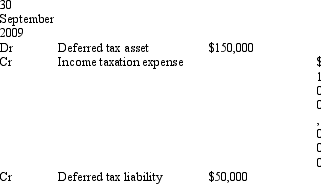

A)

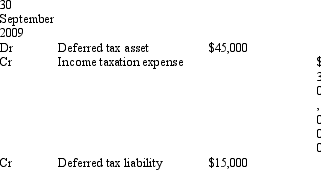

B)

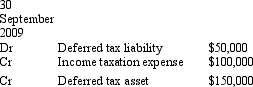

C)

D)

E) None of the given answers

Correct Answer:

Verified

Q34: The tax base of a liability must

Q41: When the carrying amount of an asset

Q46: The transfer of tax losses to other

Q48: Lesser Ltd is wholly owned by Moore

Q50: The balance sheet approach adopted in AASB

Q51: Spring Day Ltd has a piece of

Q52: Casper Ltd incurred a loss of $500,000

Q53: Criteria used by an entity to assess

Q54: Mighty Motors Ltd offers a warranty on

Q57: As at 30 June 2007, the Provision

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents