Burchells Ltd owns a machine that originally cost $36,000. It has been depreciated using the straight-line method for 3 years, giving an accumulated depreciation of $15,000 (the salvage value was estimated at $6,000 and the useful life at 6 years) . At the beginning of the current financial year its carrying value is therefore $21,000. It has been decided by the directors to revalue it to fair value, which is assessed to be $38,000. The salvage value and useful life are considered to be unchanged. What are the appropriate entries to record the revaluation and the depreciation expense for the current year (rounded to the nearest dollar) ?

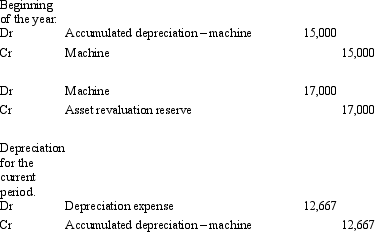

A)

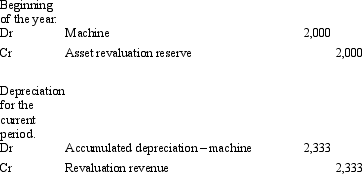

B)

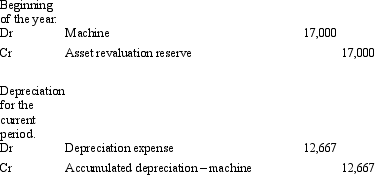

C)

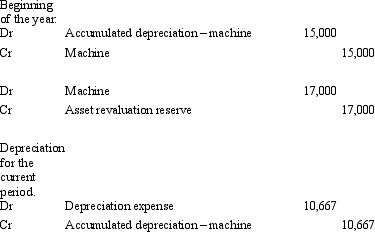

D)

E) None of the given answers.

Correct Answer:

Verified

Q21: Purple Co Ltd purchased an item of

Q25: AASB 136 requires that:

A) If a non-current

Q31: Revaluations increments are often a source of

Q37: Mendelssons Ltd has a machine that has

Q39: Once a class of non-current assets has

Q41: Palm Beach Ltd has elected to adopt

Q44: Which of the following statement is true

Q49: Mozart Ltd acquired a building for $1.5

Q50: Brown,Izan and Loh (1992)found that revaluations are

Q55: AASB 116 permits the following with respect

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents