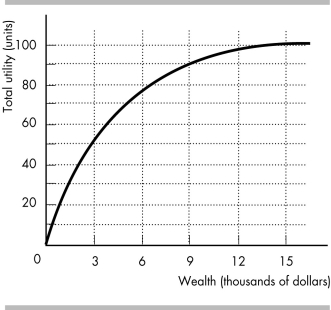

-Jennifer has the utility of wealth curve shown in the figure above. She owns a car worth $15,000, and that is her only wealth. There is a 10 percent chance that Jennifer will have an accident within a year. If she does have an accident, her car is worthless. An insurance company agrees to pay a car owner like Jennifer the full value her car, if the car owner buys the company's insurance policy. The company's operating expenses are $1,000. Jennifer will

A) not buy the company's policy because the minimum premium that the company is willing to accept is greater than the maximum premium Jennifer is willing to pay.

B) buy the company's policy because the minimum premium that the company is willing to accept is lower than the maximum premium Jennifer is willing to pay.

C) buy the company's policy because the minimum premium that the company is willing to accept is the same as the maximum premium Jennifer is willing to pay.

D) not buy the company's policy because Jennifer is risk neutral.

Correct Answer:

Verified

Q6: Q7: Contests can help explain why Q8: The big tradeoff is a tradeoff between Q9: Q10: Q12: Q13: If the interest rate is 5 percent, Q14: If the interest rate is 5 percent, Q15: Q16: Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

A) the super

A)![]()

![]()

![]()

![]()

![]()