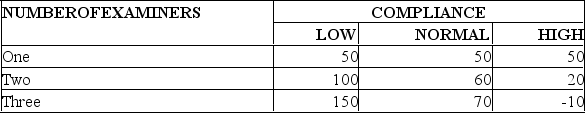

The local operations manager for the Canada Revenue Agency must decide whether to hire one,two,or three temporary tax examiners for the upcoming tax season.She estimates that net revenues (in thousands of dollars) will vary with how well taxpayers comply with the new tax code just passed by Parliament,as follows:  If she feels the chances of low,medium,and high compliance are 20%,30%,and 50%,respectively,what are the expected net revenues for the number of assistants she will decide to hire?

If she feels the chances of low,medium,and high compliance are 20%,30%,and 50%,respectively,what are the expected net revenues for the number of assistants she will decide to hire?

A) $26,000

B) $46,000

C) $48,000

D) $50,000

E) $76,000

Correct Answer:

Verified

Q35: Determining the probability distribution which results in

Q36: A former politician,who is now the owner

Q37: The local operations manager for the Canada

Q38: Which of the following is not true

Q39: The construction manager for Acme Construction,Inc.must decide

Q41: The advertising manager for Roadside Restaurants,Inc.needs to

Q43: One local hospital has just enough space

Q44: The owner of Tastee Cookies needs to

Q105: The head of operations for a movie

Q112: The head of operations for a movie

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents