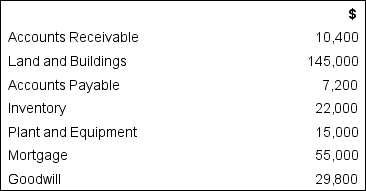

Craig Smith purchased a retail sports clothing business on 1 April.He purchased the business for $160,000.The assets and liabilities taken over were as follows:

The following transactions (events)took place during the month of April:

The following transactions (events)took place during the month of April:

• Craig invested $10,000 cash into the business.

• He purchased stock for $7,500 on credit from I Supply Ltd.

• Paid rent $900 and advertising $1,200.

• Sold inventory for $3,900 on credit (cost price was $1,350).

• Purchased a business motor vehicle for $25,000,paying a $2,500 deposit and agreeing to pay the balance over 24 months under a hire purchase agreement with A Finance Co.

• Paid wages to staff $500 and paid Craig's personal household expenses of $400.

• Sold inventory receiving cash $2,200 (cost price $750).

• A customer returned goods purchased on credit for $360 (cost price was $150).

• Craig took sports clothing for personal use (cost price $250).

• Received $1,000 from a customer paying off her account.She had deducted $50 discount before making this payment.

• Equipment was sold for $250,on credit.This had originally cost $400.

Show the effect of the opening assets and liabilities taken over,and the remaining transactions (events)on the accounting equation.

Correct Answer:

Verified

Q6: Explain why accrual accounting is the preferred

Q7: Explain the 3 aspects of the NZ

Q8: Which of the following defines Financial expenses?

A)Costs

Q9: Your friend Randolph has been reading about

Q10: The following information is available at balance

Q12: a What advantages are there in showing

Q13: What names are acceptable for the statement

Q14: Recording an item as capital expenditure instead

Q15: Which of the following items would be

Q16: Low immaterial-cost items that will benefit several

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents