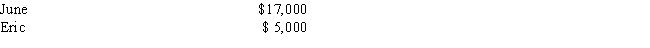

Oliver has two employees who earned the following amounts during 2015: If Oliver timely pays 5.4 percent for state unemployment tax, what is the amount of his 2015 FUTA after the state tax credit?

A) $0

B) $72

C) $112

D) $176

E) None of the above

Correct Answer:

Verified

Q47: The FUTA tax is paid by:

A)Employees only.

B)Employers

Q58: A taxpayer would be required to pay

Q62: In 2015, Willow Corporation had three employees.

Q63: George has four employees who earned $75,000,

Q64: The FUTA tax for 2015 is based

Q66: Sally is an employer with one employee,

Q72: The FUTA tax is a voluntary unemployment

Q72: Tom had net earnings of $80,000 from

Q72: Emily is a self-employed attorney.

a.

Assuming that Emily

Q79: For purposes of the new additional 0.9%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents