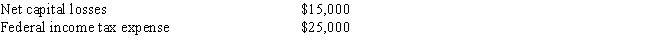

For the current year, the Beech Corporation has net income on its books of $60,000, including the following items: Federal tax depreciation exceeds the depreciation deducted on the books by $5,000. What is the corporation's taxable income?

A) $66,000

B) $90,000

C) $95,000

D) $103,000

E) None of the above

Correct Answer:

Verified

Q1: A corporation owning 80 percent or more

Q2: Corporations are not allowed to amortize the

Q9: Calculate the corporate tax liability in each

Q9: Which of the following is true with

Q11: During 2015, the Squamata Corporation, a regular

Q13: In 2015, Apricot Corporation had taxable income

Q13: Corporations may deduct without limitation any amount

Q14: A corporation may elect to take a

Q16: Which of the following statements is true

Q17: The corporate tax rates favor large corporations.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents