You Make the Call-Situation 1

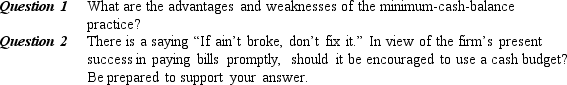

A small firm specializing in the sale and installation of swimming pools was profitable but devoted very little attention to management of its working capital. It had, for example, never prepared or used a cash budget. To be sure that money was available for payments as needed, the firm kept a minimum of $25,000 in a checking account. At times, this account grew larger; it totaled $43,000 at one time. The owner felt that this approach to cash management worked well for a small company because it eliminated all of the paperwork associated with cash budgeting. Moreover, it had enabled the firm to pay its bills in a timely manner.

Correct Answer:

Verified

Q81: If the net present value of a

Q83: Discounted cash flow (DCF) techniques compare the

Q86: Working-capital management

A) involves managing long-term assets and

Q90: If capital budgeting is so important, why

Q90: Assume that the cost of certain equipment

Q92: Discounted cash flow techniques of analysis include

A)

Q95: In making capital budgeting decisions, small business

Q98: Identify the key dates in the chronological

Q99: Discuss the working-capital cycle of a small

Q100: The Internal Rate of Return (IRR) method

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents