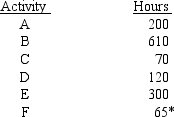

Willy is involved in a number of businesses as a consultant. Below are the businesses and the hours of activity that Willy spent in each. Identify any activities that are passive and explain why the income or loss from the other activities is not passive income or loss.  *F is Willy's sole proprietorship and he has no employees.

*F is Willy's sole proprietorship and he has no employees.

Correct Answer:

Verified

B: Willy pa...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: The Clio Corporation, an S corporation, makes

Q51: The LBJ Partnership has a March 31

Q52: Simpco Partnership has gross operating revenue of

Q53: Clarence receives a liquidating distribution of receivables

Q54: Simpco Partnership has gross operating revenue of

Q56: ABC Partnership has two assets: inventory (fair

Q57: For 2018, compare the income and FICA

Q58: For 2018, compare the income and FICA

Q59: The Walden Partnership has two 20 percent

Q60: Quincy received a liquidating distribution of $5,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents