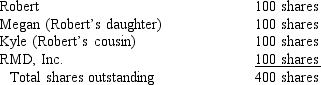

The outstanding stock of Riccardo Corporation is owned as follows:  Robert owns 50% of RMD, Inc. stock. The rest of RMD, Inc. stock is owned by unrelated parties. Riccardo Corporation redeems 90 of Robert's shares of stock for $9,000 in the only redemption transaction this year. Robert's basis for his stock is $10 per share (100 shares @ $10 = $1,000) . Riccardo Corporation has $300,000 in E&P. How much capital gain or dividend income does Robert recognize as a result of this redemption?

Robert owns 50% of RMD, Inc. stock. The rest of RMD, Inc. stock is owned by unrelated parties. Riccardo Corporation redeems 90 of Robert's shares of stock for $9,000 in the only redemption transaction this year. Robert's basis for his stock is $10 per share (100 shares @ $10 = $1,000) . Riccardo Corporation has $300,000 in E&P. How much capital gain or dividend income does Robert recognize as a result of this redemption?

A) $9,000 dividend income

B) $8,100 capital gain

C) $8,000 capital gain

D) 0

Correct Answer:

Verified

Q45: Christopher and Ashley, brother and sister, each

Q51: Maui Corporation makes two distributions during the

Q53: Walker Corporation issues one right to purchase

Q57: Maui Corporation makes two distributions during the

Q73: Tom owns 60 percent of CDF Corporation.CDF

Q75: A corporation owns 90 percent of the

Q84: The following shareholders own the outstanding stock

Q86: The outstanding stock of Riccardo Corporation is

Q90: The outstanding stock of Riccardo Corporation is

Q91: Casey Corporation has three assets when it

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents