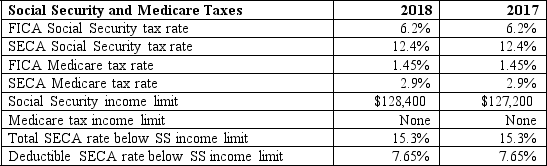

During 2018, Jackson Corporation paid Brittany a salary of $110,000. How much is Jackson Corporation's deduction (rounded to the nearest dollar) for its share of FICA taxes paid on Brittany's compensation?

A) $8,942

B) $8,415

C) $7,347

D) $6,820

Correct Answer:

Verified

Q26: Which of the following is a taxable

Q37: Which of the following would not be

Q40: Carol owns a small curio shop that

Q52: Carole, age 38, is single and works

Q53: Bill was awarded 3,000 options; each option

Q54: Warren has $62,400 of net income from

Q56: What is a phantom stock plan?

A)A purchase

Q58: Jose worked at an architectural firm as

Q59: Taxable compensation received from a business does

Q60: During 2018, Jones Corporation paid Joshua a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents