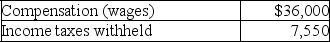

The following data were provided by the detailed payroll records of Mountain Corporation for the last week of March 2019,which will not be paid until April 5,2019:

FICA taxes at a 7.65% rate (no employee had reached the maximum).

FICA taxes at a 7.65% rate (no employee had reached the maximum).

A.Prepare the March 31,2019 journal entry to record the payroll and the related employee deductions.

B.Prepare the March 31,2019 journal entry to record the employer's FICA payroll tax expense.

C.Calculate the total payroll-related liabilities at March 31,2019 using the results of requirements (A)and (B).

Correct Answer:

Verified

Q104: Your goal is to be able to

Q105: With regard to reporting contingent liabilities on

Q106: Halbur Company reported total assets of $150,000,current

Q107: A loan supported by an agreement to

Q108: On April 1,2019,Wolf Company borrowed $5,000 on

Q110: Which of the following operating activities is

Q111: Which of the following is incorrect with

Q112: The following is a partial list of

Q113: Sharp Company borrowed $500,000 on a 6%

Q114: A company's 2019 income tax return reported

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents