ROI and Residual Income

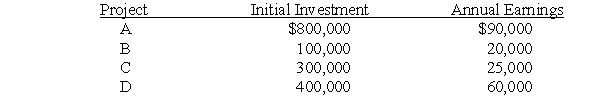

The following investment opportunities are available to an investment center manager:  Required:

Required:

a. If the investment manager is currently making a return on investment of 16 percent, which project(s) would the manager want to pursue?

b. If the cost of capital is 10 percent and the annual earnings approximate cash flows excluding finance charges, which project(s) should be chosen?

c. Suppose only one project can be chosen and the annual earnings approximate cash flows excluding finance charges. Which project should be chosen?

Correct Answer:

Verified

a. The ROI of t...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Accounting and Control

The controller of a small

Q1: Professional football teams have both a coach

Q3: Cost,Volume,Profit Analysis

Leslie Mittelberg is considering the wholesaling

Q8: Responsibility Centers

The Maple Way Golf Course is

Q14: A chair manufacturer has two divisions: framing

Q15: The Alpha Division of the Carlson Company

Q17: Opportunity Cost of Purchase Discounts and Lost

Q18: Fixed, Variable, and Average Costs

Midstate University is

Q21: Flexible Budgets

A chair manufacturer has established the

Q24: Job Cost Flows

The job cost sheet for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents