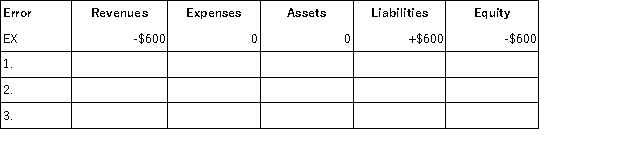

Given the table below,indicate the impact of the following errors made during the adjusting entry process.Use a "+" followed by the amount for overstatements,a "-" followed by the amount for understatements,and a "0" for no effect.The first one is done as an example.

Ex.Failed to recognize that $600 of unearned revenues,previously recorded as liabilities,had been earned by year-end.

1.Failed to accrue interest expense of $200.

2.Forgot to record $7,700 of depreciation on machinery.

3.Failed to accrue $1,300 of revenue earned but not collected.

Correct Answer:

Verified

Q118: On October 1,Goodwell Company rented warehouse space

Q120: All of the following are true regarding

Q121: Juno Company had $500 of office supplies

Q122: Using the table below,indicate the impact of

Q124: On December 31,2015 Winters Company received a

Q125: On December 1,Casualty Insurance Company borrowed $50,000

Q126: Rogers Company's employees are paid a total

Q127: On December 31,2015 Carmack Company received a

Q128: A company's employees earn a total of

Q146: The adjusting entry to record an accrued

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents