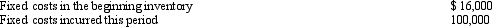

The following information regarding fixed production costs from a manufacturing firm is available for the current year:  Which of the following statements is not true?

Which of the following statements is not true?

A) The maximum amount of fixed production costs that this firm could deduct using absorption costs in the current year is $116,000.

B) The maximum difference between this firm's the current year income based on absorption costing and its income based on variable costing is $16,000.

C) Using variable costing,this firm will deduct no more than $16,000 for fixed production costs.

D) If this firm produced substantially more units than it sold in the current year,variable costing will probably yield a lower income than absorption costing.

Correct Answer:

Verified

Q165: What are the primary reasons for using

Q167: Oakwood Corporation Oakwood Corporation produces a single

Q168: Sheets Corporation The following information was extracted

Q169: Alpha,Beta,and Gamma Companies Three new companies (Alpha,Beta,and

Q170: Sheets Corporation The following information was extracted

Q173: Kellman Corporation Kellman Corporation produces a single

Q174: Oakwood Corporation Oakwood Corporation produces a single

Q175: Kellman Corporation Kellman Corporation produces a single

Q177: Kellman Corporation Kellman Corporation produces a single

Q197: Discuss underapplied and overapplied overhead and its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents