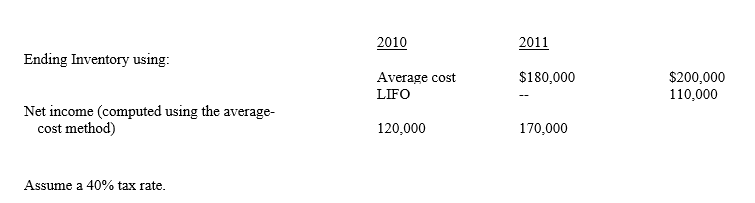

Wilma Company began operations in 2010 and uses the average cost method in costing its inventory.In 2011, Wilma is investigating a change to the LIFO method.Before making that determination, Wilma desires to determine what effect such a change will have on net income.Wilma has compiled the following information:  Assume a 40% tax rate.

Assume a 40% tax rate.

If Wilma adopted LIFO in 2011, net income would be

A) $ 80, 000

B) $116, 000

C) $170, 000

D) $224, 000

Correct Answer:

Verified

Q5: On January 1, 2010, Willis Company acquired

Q6: Which statement concerning accounting for accounting changes

Q7: When changing from LIFO to FIFO, the

Q8: Which of the following statements does not

Q9: Generally accepted methods of accounting for a

Q11: A change in accounting principle from one

Q12: The accounting changes identified by current GAAP

Q13: Exhibit 23-1 On January 1, 2010, the

Q14: A change from LIFO to FIFO should

Q15: Exhibit 23-1 On January 1, 2010, the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents