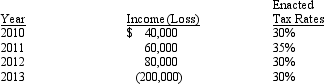

The Brownwood Company reports the following for both pretax financial and taxable income:  Brownwood uses the carryback provision for net operating losses when possible.Congress has enacted a tax rate for 2014 and future years of 40%.The entry on December 31, 2013, to record income tax expense would include a

Brownwood uses the carryback provision for net operating losses when possible.Congress has enacted a tax rate for 2014 and future years of 40%.The entry on December 31, 2013, to record income tax expense would include a

A) debit to Income Tax Refund Receivable for $24, 000

B) debit to Income Tax Refund Receivable for $45, 000

C) credit to Income Tax Benefit from Operating Losses for $45, 000

D) credit to Income Tax Expense for $45, 000

Correct Answer:

Verified

Q39: The interperiod tax allocation method that is

Q40: In 2010, its first year of

Q41: As of December 31, 2010, the Austin

Q42: Revenue from installment sales is recognized in

Q43: During its first year of operations,

Q45: Examples of positive evidence cited by the

Q46: The Channelview Company incurred the following

Q47: Harlingen Company reported the following operating

Q48: A deferred tax asset would result if

A)a

Q49: At the end of its first

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents