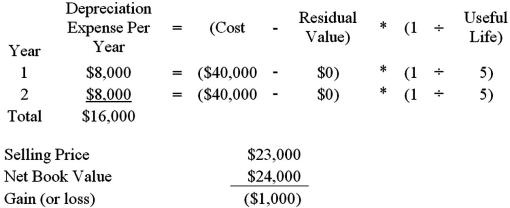

On January 1,2014,Horton Inc.sells a machine for $23,000.The machine was originally purchased on January 1,2012 for $40,000.The machine was estimated to have a useful life of 5 years and a salvage value of $0.Horton uses straight-line depreciation.In recording this transaction:

A) a loss of $1,000 would be recorded.

B) a gain of $1,000 would be recorded.

C) a loss of $17,000 would be recorded.

D) a gain of $23,000 would be recordeD.

Correct Answer:

Verified

Q101: Freight costs incurred when a long-lived asset

Q102: Extraordinary repairs

A)are revenue expenditures.

B)extend an asset's life

Q103: Accumulated depreciation is classified as a(an)

A)expense.

B)contra-asset.

C)liability.

D)stockholders' equity.

Q104: A company purchased property for $100,000.The property

Q112: Company A uses an accelerated depreciation method

Q194: Goodwill:

A)is not amortized,but is tested annually for

Q201: Your company has net sales revenue of

Q202: The fixed asset turnover ratio measures the:

A)useful

Q208: A declining fixed asset turnover ratio suggests

Q233: If net sales revenue and the average

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents