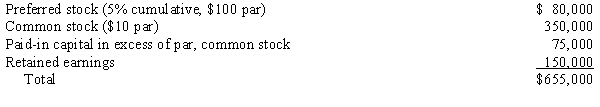

Pilatte Company acquired a 90% interest in the common stock of Sweet Company for $630,000 on January 1, 20X3, when Sweet Company had the following stockholders' equity:

The preferred stock dividends are 2 years in arrears. Any excess is attributable to equipment with a 6-year life, which is undervalued by $40,000, and to goodwill.

The preferred stock dividends are 2 years in arrears. Any excess is attributable to equipment with a 6-year life, which is undervalued by $40,000, and to goodwill.

Required:

Prepare a determination and distribution of excess schedule for the investment in Sweet Company.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Page & Seed scenario:

Page Company purchased an

Q21: Company P Industries purchased a 70% interest

Q24: On January 1, 20X1, Company P purchased

Q26: It is common for a parent firm

Q26: On January 1, 20X1, Pepper Company

Q27: On January 1, 20X1, Parent Company acquired

Q29: Saddle Corporation is an 80%-owned subsidiary of

Q29: On January 1, 20X1, Parent Company

Q30: On January 1, 20X1, Parent Company acquired

Q34: Company P owns an 90% interest in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents