Scenario 3-3

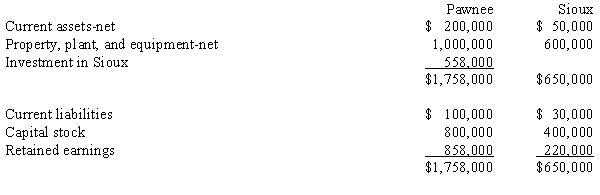

Balance sheet information for Pawnee Company and its 90%-owned subsidiary, Sioux Corporation, at December 31, 20X1, is summarized as follows:

Pawnee acquired its interest in Sioux for cash at book value several years ago when Sioux's assets and liabilities were equal to their fair values.

Pawnee acquired its interest in Sioux for cash at book value several years ago when Sioux's assets and liabilities were equal to their fair values.

-Refer to Scenario 3-3. Consolidated total assets of Pawnee and Sioux, at December 31, 20X1, will be ____.

A) $1,785,000

B) $1,850,000

C) $2,343,000

D) $2,408,000

Correct Answer:

Verified

Q10: Scenario 3-1

Pedro purchased 100% of the

Q11: On January 1, 20X1, Payne Corp. purchased

Q12: Scenario 3-2

On January 1, 20X1, Promo, Inc.

Q14: Patti Corp. has several subsidiaries (Aeta, Beta,

Q16: Scenario 3-2

On January 1, 20X1, Promo, Inc.

Q17: If the investment in subsidiary account is

Q18: Scenario 3-2

On January 1, 20X1, Promo, Inc.

Q19: In consolidated financial statements, it is expected

Q20: What is the effect if an unconsolidated

Q20: Which of the following statements applying to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents