Scenario 3-3

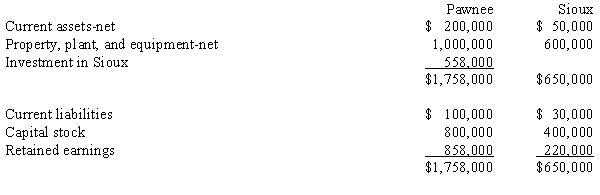

Balance sheet information for Pawnee Company and its 90%-owned subsidiary, Sioux Corporation, at December 31, 20X1, is summarized as follows:

Pawnee acquired its interest in Sioux for cash at book value several years ago when Sioux's assets and liabilities were equal to their fair values.

Pawnee acquired its interest in Sioux for cash at book value several years ago when Sioux's assets and liabilities were equal to their fair values.

-Refer to Scenario 3-3. The consolidated balance sheet of Pawnee and Sioux at December 31, 20X1 will show

A) Investment in Sioux, $558,000.

B) Capital stock, $800,000.

C) Retained earnings, $1,078,000.

D) Noncontrolling interest, $65,000.

Correct Answer:

Verified

Q2: Pahl Corporation owns a 60% interest in

Q3: Scenario 3-1

Pedro purchased 100% of the

Q6: In a mid-year purchase when the subsidiary's

Q10: Scenario 3-1

Pedro purchased 100% of the

Q11: On January 1, 20X1, Payne Corp. purchased

Q12: Scenario 3-2

On January 1, 20X1, Promo, Inc.

Q15: How is the portion of consolidated earnings

Q16: Alpha purchased an 80% interest in Beta

Q20: On January 1, 20X1, Rabb Corp. purchased

Q22: On January 1, 20X1, Piston, Inc. acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents