Scenario 2-1

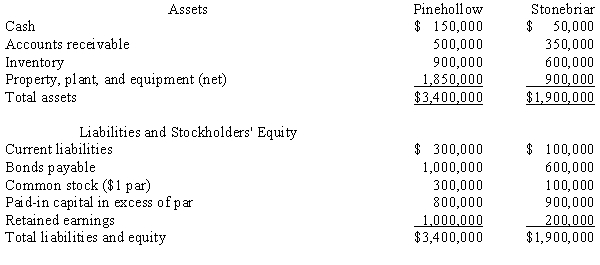

Pinehollow acquired all of the outstanding stock of Stonebriar by issuing 100,000 shares of its $1 par value stock. The shares have a fair value of $15 per share. Pinehollow also paid $25,000 in direct acquisition costs. Prior to the transaction, the companies have the following balance sheets:

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively.

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively.

-Refer to Scenario 2-1. Goodwill associated with the purchase of Stonebriar is ____.

A) $100,000

B) $125,000

C) $300,000

D) $325,000

Correct Answer:

Verified

Q3: When it purchased Sutton, Inc. on January

Q4: The goal of the consolidation process is

Q5: Scenario 2-1

Pinehollow acquired all of the outstanding

Q6: Which of the following costs of a

Q8: Parr Company purchased 100% of the voting

Q10: Pagach Company purchased 100% of the voting

Q11: The investment in a subsidiary should be

Q18: A subsidiary was acquired for cash in

Q27: On June 30, 20X1, Naeder Corporation purchased

Q28: The SEC requires the use of push-down

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents