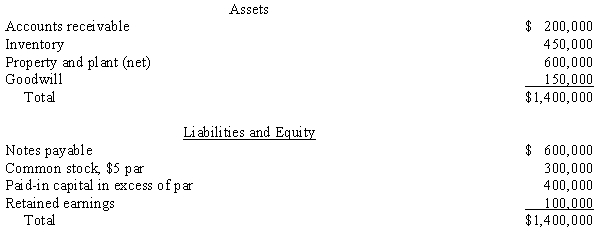

Supernova Company had the following summarized balance sheet on December 31, 20X1:

The fair value of the inventory and property and plant is $600,000 and $850,000, respectively.

The fair value of the inventory and property and plant is $600,000 and $850,000, respectively.

Assume that Redstar Corporation exchanges 75,000 of its $3 par value shares of common stock, when the fair price is $20/share, for 100% of the common stock of Supernova Company. Redstar incurred acquisition costs of $5,000 and stock issuance costs of $5,000.

Required:

a.

What journal entry will Redstar Corporation record for the investment in Supernova?

b.

Prepare a supporting value analysis and determination and distribution of excess schedule

c.

Prepare Redstar's elimination and adjustment entry for the acquisition of Supernova.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Consolidated financial statements are designed to provide:

A)informative

Q10: Pagach Company purchased 100% of the voting

Q11: The investment in a subsidiary should be

Q13: The SEC and FASB has recommended that

Q14: In an 80% purchase accounted for as

Q17: Consolidated financial statements are appropriate even without

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents