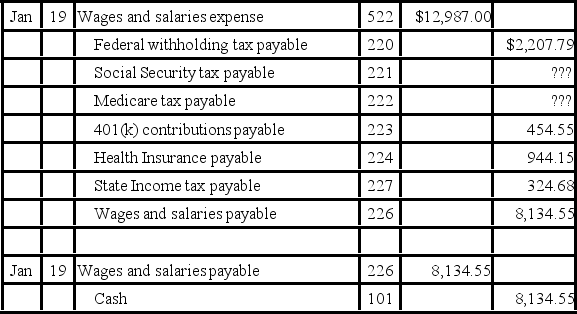

The following data is for the January 19 pay date for Waryzbok Inc.:  Which of the following represents the missing Social Security and Medicare taxes?

Which of the following represents the missing Social Security and Medicare taxes?

A) Social Security tax, $746.66; Medicare tax, $174.62

B) Social Security tax, $188.31; Medicare tax, $805.19

C) Social Security tax, $204.15: Medicare tax, $792.35

D) Social Security tax, $792.35; Medicare tax, $204.15

Correct Answer:

Verified

Q21: Which of the following is an example

Q23: Which of these accounts is increased by

Q24: When a firm has wages earned but

Q25: What are the General Journal entries that

Q28: On December 1,20XX,Riley Sanders invested $250,000 to

Q30: If a firm accrues the payroll due

Q30: In the following payroll transaction, what is

Q31: Supermeg Dry Cleaners had the following payroll

Q38: Which of the following is an example

Q39: What is the term for transferring data

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents