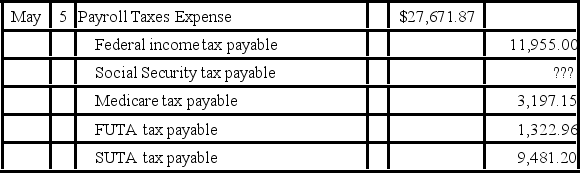

Didier and Sons had the following employer's share payroll tax general journal entry for the May 5 pay date:  What is the amount of the Social Security tax payable?

What is the amount of the Social Security tax payable?

A) $2,572.59

B) $1,875.98

C) $1,582.39

D) $1,715.56

Correct Answer:

Verified

Q34: Which of the following is an example

Q37: McHale Enterprises has the following incomplete General

Q38: Dooley Publishing has the following payroll data

Q40: Supermeg Dry Cleaners had the following payroll

Q43: Rushing River Boats has the following data

Q45: Rushing River Boats has the following data

Q46: Which of the following payroll items is

Q47: Which of the following financial report(s) reflect

Q51: On which financial report will employer-paid portions

Q56: Which report contains employer share tax expenses

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents