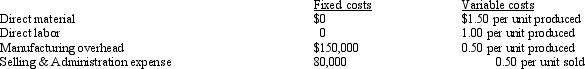

Kellman Corporation Kellman Corporation produces a single product that sells for $7.00 per unit. Standard capacity is 100,000 units per year; 100,000 units were produced and 80,000 units were sold during the year. Manufacturing costs and selling and administrative expenses are presented below.

There were no variances from the standard variable costs. Any under- or overapplied overhead is written off directly at year-end as an adjustment to cost of goods sold. Kellman Corporation had no inventory at the beginning of the year.

Kellman Corporation had no inventory at the beginning of the year.

Refer to Kellman Corporation. In presenting inventory on the balance sheet at December 31, the unit cost under absorption costing is

A) $2.50.

B) $3.00.

C) $3.50.

D) $4.50.

Correct Answer:

Verified

Q112: What are three reasons that overhead must

Q162: Alpha, Beta, and Gamma Companies Three new

Q163: Sheets Corporation The following information was extracted

Q164: Oakwood Corporation Oakwood Corporation produces a single

Q166: Sheets Corporation The following information was extracted

Q167: A firm has fixed costs of $200,000

Q168: Oakwood Corporation Oakwood Corporation produces a single

Q171: Alpha, Beta, and Gamma Companies Three new

Q172: Kellman Corporation Kellman Corporation produces a single

Q175: For its most recent fiscal year,a firm

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents