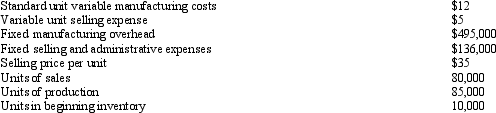

Awesome Athletics, Inc. has developed a new design to produce hurdles that are used in track and field competition. The company's hurdle design is innovative in that the hurdle yields when hit by a runner and its height is extraordinarily easy to adjust. Management estimates expected annual capacity to be 90,000 units; overhead is applied using expected annual capacity. The company's cost accountant predicts the following current year activities and related costs:

Other than any possible under- or overapplied fixed overhead, management expects no variances from the previous manufacturing costs. Under- or overapplied fixed overhead is to be written off to Cost of Goods Sold.

Other than any possible under- or overapplied fixed overhead, management expects no variances from the previous manufacturing costs. Under- or overapplied fixed overhead is to be written off to Cost of Goods Sold.

Required:

Correct Answer:

Verified

Q183: Discuss the application of the high-low method.

Q184: Farris Corporation produces a single product. The

Q185: Dynamic Trainers provides a personalized training program

Q185: Why is variable costing not used extensively

Q186: Wyman Company owns two luxury automobiles that

Q187: William Shafer Company used least squares regression

Q190: Davis Corporation has the following data relating

Q190: What are the major differences between variable

Q196: O'Brien Corporation applies overhead at the rate

Q196: How can a company produce both variable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents