Hefner Corporation

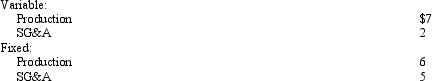

Hefner Corporation is comprised of two divisions: X and Y. X currently produces and sells a gear assembly used by the automotive industry in electric window assemblies. X is currently selling all of the units it can produce (25,000 per year) to external customers for $25 per unit. At this level of activity, X's per unit costs are:

Y Division wants to purchase 5,000 gear assemblies per year from X Division. Y Division currently purchases these units from an outside vendor at $22 each.

Y Division wants to purchase 5,000 gear assemblies per year from X Division. Y Division currently purchases these units from an outside vendor at $22 each.

Refer to Hefner Corporation. What will be the effect on overall corporate profits if the two divisions agree to an internal transfer of 5,000 units?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q165: Muskogee Savings and Loan

Muskogee Savings and Loan

Q166: Muskogee Savings and Loan

Muskogee Savings and Loan

Q167: Ideal Homes Corporation

The Carpet Division of Ideal

Q168: Wellston Medical Clinic has two service departments:

Q169: Guthrie Wire Corporation

The Wire Products Division of

Q171: Guthrie Wire Corporation

The Wire Products Division of

Q172: Ideal Homes Corporation

The Carpet Division of Ideal

Q173: Guthrie Wire Corporation

The Wire Products Division of

Q174: Hefner Corporation

Hefner Corporation is comprised of two

Q175: Ideal Homes Corporation

The Carpet Division of Ideal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents