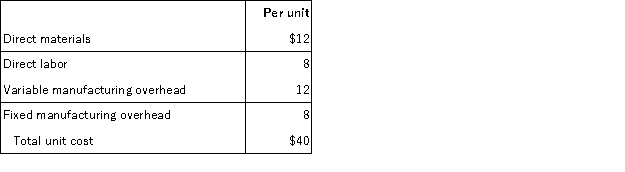

Olive Corp. currently makes 20,000 subcomponents a year in one of its factories. The unit costs to produce are:  An outside supplier has offered to provide Olive Corp with the 20,000 subcomponents at a $36 per unit price. Fixed overhead is not avoidable. If Olive Corp rejects the outside offer, what will be the effect on short-term profits?

An outside supplier has offered to provide Olive Corp with the 20,000 subcomponents at a $36 per unit price. Fixed overhead is not avoidable. If Olive Corp rejects the outside offer, what will be the effect on short-term profits?

A) $80,000 increase

B) no change

C) $160,000 decrease

D) $80,000 decrease

Correct Answer:

Verified

Q64: Franklin, Inc. has two divisions, Seward and

Q65: Olive Corp. currently makes 20,000 subcomponents a

Q66: Manor, Inc. currently manufactures 1,000 subcomponents per

Q67: Clifford, Inc. currently manufactures 2,000 subcomponents in

Q67: Which of the following is irrelevant to

Q68: Power Inc. has two divisions, Windsor and

Q72: The accounting firm of Pie and Lowell

Q72: Davenport Inc. has two divisions, Howard and

Q73: Moss, Inc. currently processes payroll in its

Q74: Chafford, Inc. currently manufactures 2,000 subcomponents in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents