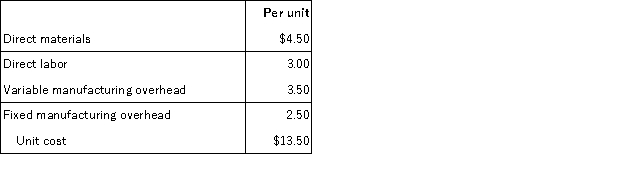

Deer currently manufactures a subcomponent that is used in its main product. A supplier has offered to supply all the subcomponents needed at a price of $12. Deer currently produces 80,000 subcomponents at the following manufacturing costs:  a. If Deer has no alternative uses for the manufacturing capacity, what would be the profit impact of buying the subcomponents from the supplier?

a. If Deer has no alternative uses for the manufacturing capacity, what would be the profit impact of buying the subcomponents from the supplier?

b. If Deer has no alternative uses for the manufacturing capacity, what would be the maximum price per unit they would be willing to pay the supplier?

c. Now assume Deer would avoid $120,000 in equipment leases and salaries if the subcomponent were purchased from the supplier. Now what would be the profit impact of buying from the supplier?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q112: Managerial decision makers must often consider non-economic

Q114: Bancroft currently manufactures a subcomponent that is

Q115: Shirley Inc. has three divisions, King, West

Q117: Shirley Inc. has three divisions, King, West

Q118: Capitol has received a special order for

Q121: Pasadena Corp. produces three products, and currently

Q122: Hanson Corp. produces three products, and is

Q123: Hanson Corp. produces three products, and is

Q124: Consider the most constrained resource you have:

Q135: Pinehurst,Inc.currently sells 20,000 units of its product

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents