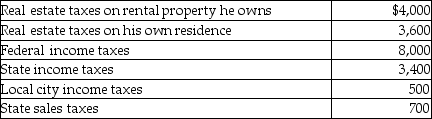

Matt paid the following taxes in 2015:  What amount can Matt deduct as an itemized deduction on his tax return?

What amount can Matt deduct as an itemized deduction on his tax return?

A) $7,500

B) $11,500

C) $15,500

D) $8,200

Correct Answer:

Verified

Q9: Leo spent $6,600 to construct an entrance

Q12: Medical expenses are deductible as a from

Q20: Expenditures incurred in removing structural barriers in

Q22: Mitzi's medical expenses include the following:

Q23: Assessments or fees imposed for specific privileges

Q25: Mr.and Mrs.Thibodeaux,who are filing a joint return,have

Q26: Caleb's medical expenses before reimbursement for the

Q27: Assessments made against real estate for the

Q39: Foreign real property taxes and foreign income

Q276: Patrick and Belinda have a twelve- year-

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents