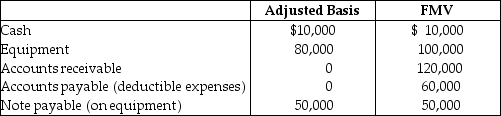

Martin operates a law practice as a sole proprietorship using the cash method of accounting.Martin incorporates the law practice and transfers the following items to a new,solely owned corporation.  Martin must recognize a gain of ________ and has a stock basis of ________:

Martin must recognize a gain of ________ and has a stock basis of ________:

A) $0; $30,000

B) $0; $40,000

C) $20,000; $30,000

D) $20,000; $40,000

Correct Answer:

Verified

Q66: Maria has been operating a business as

Q69: Identify which of the following statements is

Q71: Chris transfers land with a basis of

Q74: Lynn transfers land having a $50,000 adjusted

Q76: Silvia transfers to Leaf Corporation a machine

Q79: Jeremy operates a business as a sole

Q80: Mario and Lupita form a corporation in

Q82: Frans and Arie own 75 shares and

Q89: This year, John, Meg, and Karen form

Q95: On July 9, 2008, Tom purchased a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents