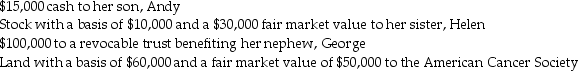

Gloria makes the following gifts during the year:  Before considering the unified credit,what are Gloria's taxable gifts?

Before considering the unified credit,what are Gloria's taxable gifts?

A) $17,000

B) $45,000

C) $95,000

D) $121,000

Correct Answer:

Verified

Q62: Identify which of the following statements is

Q69: In the current year,Melanie makes two transfers

Q87: Elaine loaned her brother, Mike, $175,000 to

Q89: Virginia gave stock with an adjusted basis

Q91: Steve gave stock with an adjusted basis

Q92: In 2013, Lilly makes taxable gifts aggregating

Q92: Terry is considering transferring assets valued at

Q96: Roger makes a $1,000,000 cash gift on

Q99: Tracy gave stock with an adjusted basis

Q104: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents