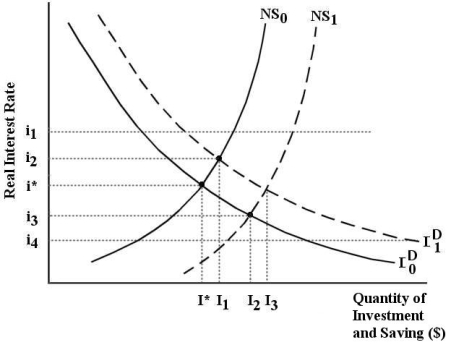

The diagram below show the market for financial capital assuming that national income is constant at potential GDP,Y*.  FIGURE 25-2 Refer to Figure 25-2.Suppose national saving is reflected by NS0 and investment demand is reflected by I0D.Now suppose there is a reduction in government purchases.What is the effect on investment demand?

FIGURE 25-2 Refer to Figure 25-2.Suppose national saving is reflected by NS0 and investment demand is reflected by I0D.Now suppose there is a reduction in government purchases.What is the effect on investment demand?

A) National saving shifts to NS1,causing an increase in the quantity of investment demanded from I* to I2.

B) There is no effect on NS or ID,and the quantity of investment demanded remains at I*.

C) Investment demand shifts to I1D,causing an increase in the quantity of investment demanded from I* to I1.

D) Investment demand shifts to I1D, causing an increase in the quantity of investment demanded from I* to I3.

E) National saving shifts to NS1,and investment demand shifts to I1D,causing an increase in the quantity of investment demanded from I* to I3.

Correct Answer:

Verified

Q61: The Neoclassical growth model assumes that,with a

Q62: Which of the following is a central

Q63: The diagram below show the market for

Q64: The Neoclassical growth model assumes that,with a

Q65: In the Neoclassical growth model,decreases in the

Q67: In the Neoclassical growth model,if capital and

Q68: One important assumption of the Neoclassical growth

Q69: In the long run,an increase in the

Q70: The main properties of a Neoclassical aggregate

Q71: The diagram below show the market for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents