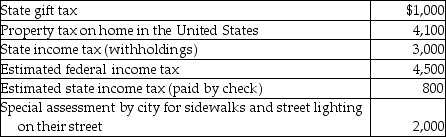

During the year Jason and Kristi, cash basis taxpayers, paid the following taxes:  What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

A) $7,900

B) $8,900

C) $10,900

D) $15,400

Correct Answer:

Verified

Q12: All of the following are deductible as

Q16: Van pays the following medical expenses this

Q19: All of the following payments for medical

Q30: Linda had a swimming pool constructed at

Q31: The following taxes are deductible as itemized

Q36: Doug pays a county personal property tax

Q41: In 2014 Sela traveled from her home

Q45: Investment interest expense which is disallowed because

Q46: Matt paid the following taxes in 2014:

Q48: Mr. and Mrs. Thibodeaux, who are filing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents