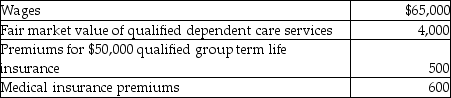

Carl filed his tax return, properly claiming the head of household filing status. Carl's employer paid or provided the following to Carl:  How much of this income should Carl report?

How much of this income should Carl report?

A) $65,000

B) $69,000

C) $69,500

D) $70,100

Correct Answer:

Verified

Q61: Rick chose the following fringe benefits under

Q67: Healthwise Ambulance requires its employees to be

Q68: All of the following are requirements for

Q70: All of the following items are excluded

Q72: Chad and Jaqueline are married and have

Q73: Lindsay Corporation made the following payments to

Q73: Nelda suffered a serious stroke and was

Q73: Joe Black, a police officer, was injured

Q75: Miranda is not a key employee of

Q78: Which one of the following fringe benefits

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents