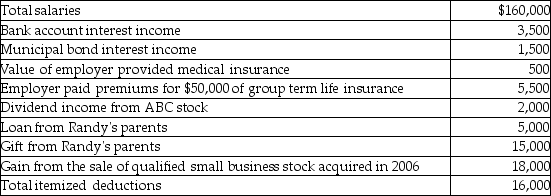

Randy and Sharon are married and have two dependent children. They also fully support Sharon's mother who lives with them and has no income. Their 2014 tax and other related information is as follows:

Compute Randy and Sharon's taxable income. (Show all calculations in good form.)

Compute Randy and Sharon's taxable income. (Show all calculations in good form.)

Correct Answer:

Verified

Q65: An electronics store sold a home theater

Q82: Jan has been assigned to the Rome

Q82: After he was denied a promotion,Daniel sued

Q85: Melanie,a U.S.citizen living in Paris,France,for the last

Q85: Jamal,age 52,is a human resources manager for

Q87: In 2006,Gita contributed property with a basis

Q89: Adam purchased stock in 2006 for $100,000.He

Q90: The discharge of certain student loans is

Q92: This year,Jason sold some qualified small business

Q106: Faye is a marketing manager for Healthy

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents