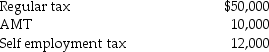

Beth and Jay project the following taxes for the current year:

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a. Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b. Preceding tax year-AGI of $155,000 and total taxes of $50,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: Sam and Megan are married with two

Q111: Tom and Anita are married, file a

Q111: Tyne is single and has AGI of

Q115: Sonya started a self-employed consulting business in

Q116: Hawaii, Inc., began a child care facility

Q117: During the year,Jim incurs $50,000 of rehabilitation

Q117: Tyler and Molly, who are married filing

Q121: Bonjour Corp.is a U.S.-based corporation with operations

Q126: Discuss when Form 6251,Alternative Minimum Tax,must be

Q1631: Nick and Nicole are both 68 years

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents