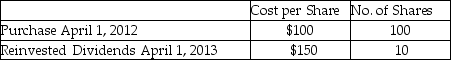

Rachel holds 110 shares of Argon Mutual Fund. She is planning to sell 90 shares. Her record of the share purchases is noted below. What could be her basis for the 90 shares to be sold for purposes of determining gain?

A) $9,000

B) $9,500

C) $9,409

D) Any of the above could be used as basis for the 90 shares sold.

Correct Answer:

Verified

Q23: Kathleen received land as a gift from

Q24: In a basket purchase,the total cost is

Q26: If stock sold or exchanged is not

Q28: Allison buys equipment and pays cash of

Q33: Capitalization of interest is required if debt

Q33: Unless the alternate valuation date is elected,the

Q35: Edward purchased stock last year as follows:

Q35: An uncle gifts a parcel of land

Q37: Kathleen received land as a gift from

Q40: If the stock received as a nontaxable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents