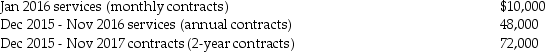

The Cable TV Company, an accrual basis taxpayer, allows its customers to pay by the month, by the year, or two years in advance. In December 2015, the company collected the following amounts applicable to future services:  Assuming Cable TV wants to minimize income reported for 2015, what is the amount of gross income that must be reported for 2015 and how much of the income from these contracts will be reported in 2016?

Assuming Cable TV wants to minimize income reported for 2015, what is the amount of gross income that must be reported for 2015 and how much of the income from these contracts will be reported in 2016?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Norah's Music Lessons Inc.is a calendar year

Q45: Speak Corporation,a calendar year cash basis taxpayer,sells

Q47: Which of the following advance payments cannot

Q47: One of the requirements that must be

Q48: Improvements to leased property made by a

Q52: Gains realized from property transactions are included

Q54: CT Computer Corporation, an accrual basis taxpayer,

Q55: Which of the following constitutes constructive receipt

Q57: Gabe Corporation,an accrual-basis taxpayer that uses the

Q58: For a cash-basis taxpayer,security deposits received on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents