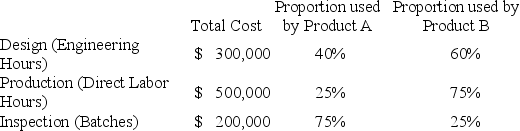

Carter,Inc.uses a traditional volume-based costing system in which direct labor hours are the allocation base.Carter produces two different products: Product A,which uses 100,000 direct labor hours,and Product B,which uses 300,000 direct labor hours.Carter is considering switching to an ABC system by splitting its manufacturing overhead cost of $1,000,000 across three activities: Design,Production,and Inspection.Under the traditional volume-based costing system,the predetermined overhead rate is $2.50/direct labor hour.Under the ABC system,the cost of each activity and proportion of the activity drivers used by each product are as follows:

Required:

Required:

a.Calculate the indirect manufacturing costs assigned to Product A under the traditional costing system.

b.Calculate the indirect manufacturing costs assigned to Product B under the traditional costing system.

c.Calculate the indirect manufacturing costs assigned to Product A under the ABC system.

d.Calculate the indirect manufacturing costs assigned to Product B under the ABC system.

e.Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Correct Answer:

Verified

b.$750,000 ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q120: Which type of quality cost would a

Q121: Fremont Systems produces two different products,Product A,which

Q122: Harwell,Inc.produces two different products,Product A and Product

Q123: Harwell,Inc.uses a traditional volume-based costing system in

Q124: Hayden,Inc.produces two different products,Product A and Product

Q126: Dogs for Diabetes (DFD)is a not-for-profit organization

Q127: Atlanta Systems produces two different products,Product A,which

Q128: Harwell,Inc.produces two different products,Product A and Product

Q129: Carter,Inc.produces two different products,Product A and Product

Q130: Hayden,Inc.produces two different products,Product A and Product

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents