Use the information below to answer the following questions.

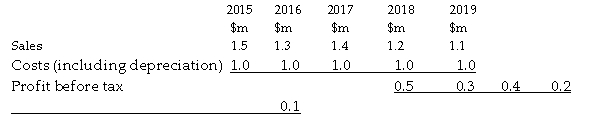

Y3 Ltd is expanding its production of binoculars. The plant is expected to cost $750,000 and have a life of 5 years and a nil residual value. It will be ready for operation on 31 December 2014. The following income statement figures for the new binoculars are forecast:  Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation.

Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation.

-Refer to the table above. The accounting rate of return is:

A) 30%.

B) 50%.

C) 80%.

D) 40%.

Correct Answer:

Verified

Q35: The finding from surveys of the methods

Q36: The main disadvantage of the internal rate

Q37: Using the net present value method, the

Q38: If a project has a net present

Q39: If you banked $27,778 today at an

Q41: Use the information below to answer the

Q42: A problem with the internal rate of

Q43: The formula for net present value per

Q44: Which of these is an advantage of

Q45: The net present value method of investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents