Use the information below to answer the following questions.

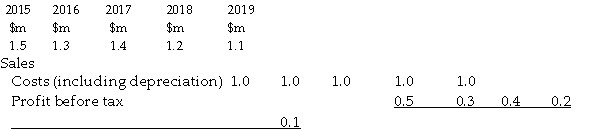

Y3 Ltd is expanding its production of binoculars. The plant is expected to cost $750,000 and have a life of 5 years and a nil residual value. It will be ready for operation on 31 December 2014. The following income statement figures for the new binoculars are forecast:  Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation.

Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation.

-Refer to the table above. The payback period is:

A) between years 3 and 4.

B) between years 1 and 2.

C) between years 2 and 3.

D) between years 4 and 5.

Correct Answer:

Verified

Q24: Which of these factors influences the returns

Q25: Use the information below to answer the

Q26: The profitability index allows potential investors to:

A)

Q27: All of the investment appraisal methods below

Q28: The time value of money is an

Q30: TG Industries is considering investing in a

Q31: The factor in net present value analysis

Q32: The decision rule for the payback method

Q33: Use the information below to answer the

Q34: Manosteel Ltd is considering the purchase of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents