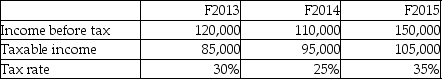

What is the tax expense under the deferral method for F2015?

A) $27,500

B) $36,000

C) $36,750

D) $52,500

Correct Answer:

Verified

Q4: Which method does not use "temporary differences"

Q5: What is one reason to use the

Q8: How much tax would be reported under

Q9: What is the tax expense under the

Q9: Which statement is accurate?

A)Accounting income is generally

Q10: What is the deferred tax liability under

Q12: What is the income tax payable under

Q13: Which statement best describes the "deferral method"?

A)This

Q16: What is the income tax payable under

Q19: Which method reflects the tax effect in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents