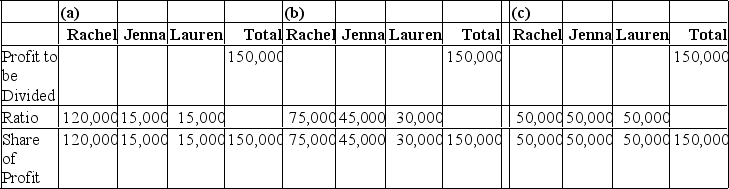

Rachel,Jenna and Lauren are partners with capital balances of $80,000,$10,000,and $10,000,respectively.Profit for the year is $150,000.Prepare the necessary journal entries to close Income Summary to the capital accounts if:(a)The partners agree to divide income based on their beginning-of-year capital balances.(b)The partners agree to divide income based on the ratio of 5:3:2,respectively.(c)The partnership agreement is silent as to division of income.

Correct Answer:

Verified

Q73: Cook and Parker formed a partnership with

Q74: On August 1,Nola and Verna decide

Q76: Discuss the accounting issues involved in the

Q77: Armstrong plans to leave the JT Partnership.At

Q79: Yee,Young,and Kong form a partnership.Yee contributes $50,000

Q80: Discuss the options for the allocation of

Q81: On January 1,2021,Jack and Maya formed a

Q82: The partners of the Blue Tooth Partnership

Q83: The partners of the Blue Tooth Partnership

Q128: Explain the steps involved in the liquidation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents