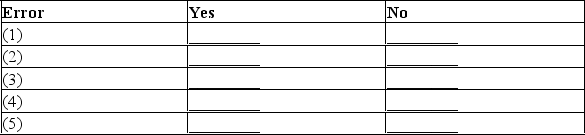

After preparing an unadjusted trial balance at year-end, the accountant for Chu Design Company discovered the following errors:(1) The payment of the $225 telephone bill for December was recorded twice.(2) The payment of a $1,000 note payable was recorded as a debit to Cash and a debit to Notes Payable.(3) A $900 withdrawal by the owner was recorded to the correct accounts as $90.(4) An additional investment of $5,000 by the owner was recorded as a debit to

G. Chu, Capital and a credit to Cash.(5) A credit purchase of office equipment for $1,800 was recorded as a debit to the Office Equipment account with no offsetting credit entry. Using the form below, indicate if each error would cause the trial balance to be out of balance. Would the error cause the trial balance to be out of balance?

Would the error cause the trial balance to be out of balance?

Would the error cause the trial balance to be out of balance?

Correct Answer:

Verified

Q123: The following postings show transactions for November,

Q124: For each of the following errors, indicate

Q125: KrenzKarKare, owned and operated by Karl Krenz,

Q126: Dave Shurek started Hindsight Electric in February

Q127: On December 2, 2020, the Tropic Company

Q130: Charlene Addemup prepared the following trial balance

Q131: The following are all of the accounts

Q132: Discuss the use of the trial balance.

Q133: A business paid $100 to Karen Smith

Q195: Explain the recording and posting processes.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents