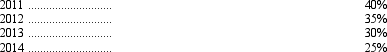

Schaeffer Products, Inc., reported an excess of warranty expense over warranty deductions of $72,000 for the year ended December 31, 2011. This temporary difference will reverse in equal amounts over the years 2012 to 2014. The enacted tax rates are as follows:

The reporting for this temporary difference at December 31, 2011, would be a

A) deferred tax liability of $28,800.

B) deferred tax asset of $28,800.

C) current deferred tax liability of $8,400 and a noncurrent deferred tax liability of $13,200.

D) current deferred tax asset of $8,400 and a noncurrent deferred tax asset of $13,200.

Correct Answer:

Verified

Q24: Warren Corporation began operations in 2008 and

Q26: The Indy Company had taxable income of

Q27: The following information is taken from Blackhawk

Q29: The Gayle Corporation reported a $66,000 operating

Q30: Analysis of the assets and liabilities of

Q31: In 2011, The Worf Company, reported pretax

Q32: Historically,the United Kingdom has recognized only those

Q32: Begal Corporation paid $20,000 in January of

Q33: Eden Company had pretax accounting income of

Q40: The asset-liability method of interperiod tax allocation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents